Irish Payslip Explanation

Irish Payslip Explanation

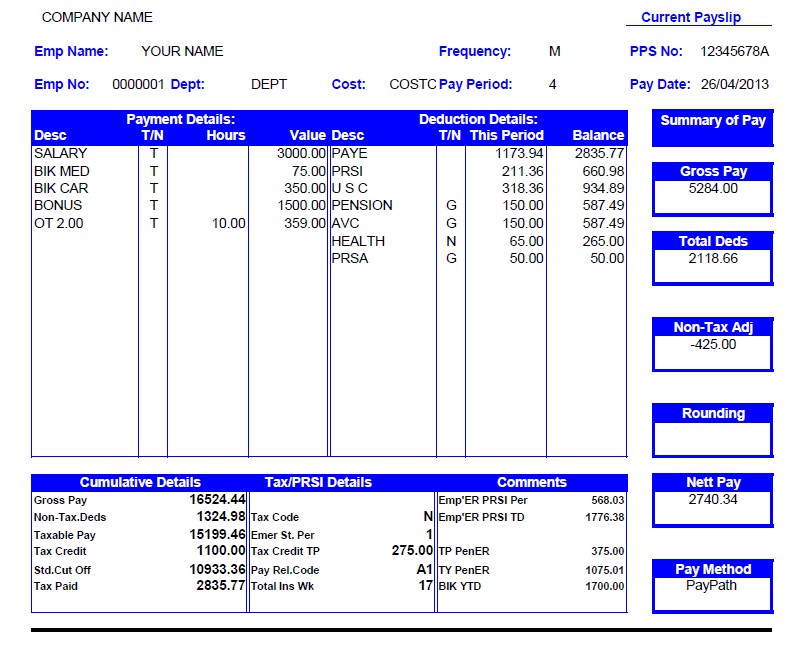

Please note that this payslip is for illustration purpose only. Your actual payslip may vary in layout and terminology used.

Standard Terms and what they mean

- COMPANY NAME: this the name of your employer.

- CURRENT PAYSLIP: this indicates that this is payslip for this pay period.

- EMP NAME: this is where your name appears on the payslip.

- FREQUENCY: this indicates your pay frequency. M = Monthly, W = Weekly, F = Fortnightly, 4 = Four-Weekly, B = Bi-Monthly.

- PPS NO: this is your PPS Number (Personal Public Service Number).

- EMP NO: this is your employee / staff number.

- DEPT: this is the department allocated to you by your employer.

- COST: this is the cost center allocated to you by your employer.

- PAY PERIOD: this is the pay period the payment relates to. e.g. 4 = April for monthly paid and 4 = Week number 4 if weekly paid.

- PAY DATE: this is the date when you would receive the Nett Pay in your account.

- PAYMENT DETAILS: this lists out what you have been paid for this pay period.

- DESC: Name of the payment(s) you are paid for.

- T/N: Taxable or Nett payment indicator.

- HOURS: If any hours are paid, they will be listed under hours.

- VALUE: this is the value for each payment made to you.

- DEDUCTION DETAILS: this lists out all the statutory deductions and voluntary contributions by you.

- DESC: Lists out the statutory and voluntary contributions.

- T/N: G means Gross Deduction and N means Nett Deduction. Gross Deductions are applied to your Gross income and

Nett Deductions are taken before the Nett Pay calculation. - THIS PERIOD: Value this period.

- BALANCE: Year to date balance.

- PAYE: Pay As You Earn (Income Tax).

- PRSI: Pay Related Social Insurance.

- U S C: Universal Social Charge.

- OTHER DEDUCTIONS: These are voluntary contributions.

- PENSION: this is the pension contribution you made.

- AVC: this is Additional Voluntary Contributions towards pension.

- HEALTH: this is health insurance contribution for dependents.

- PRSA: this is Personal Retirement Savings Account contribution.

- SUMMARY OF PAY: A Summary of your Pay this period.

- GROSS PAY: total taxable income this period.

- TOTAL DEDS: total deductions this period. Statutory and Voluntary Contributions.

- NON-TAX ADJ: Non Taxable Adjustments.

- ROUNDING: If there was any rounding carried out it will be listed here.

- NETT PAY: The amount you will receive after paying all statutory taxes and voluntary contributions.

- PAY METHOD: The way you get paid. PayPath = Directly to your bank, Cheque = Employer pays you by cheque.

- CUMMULATIVE DETAILS: Your year to date earnings and tax allowance summary.

- GROSS PAY: Your Total earnings in the current year.

- NON-TAX DEDS: Your pension / PRSA and other Gross deduction contributions this year.

- TAXABLE PAY: Your Taxable earnings in the current year.

- TAX CREDIT: Your Personal Tax Credit used this year.

- STD. CUT OFF: Your Standard Rate Cut-Off Point used this year.

- TAX PAID: Tax paid (PAYE) so far this year.

- TAX/PRSI DETAILS: Tax Status and PRSI Contribution details.

- TAX CODE: The tax code used to calculate your tax (PAYE). N = Normal / Cumulative Basis, W = Week 1 / Month 1 Basis,

E = Emergency Basis. - EMR ST PERIOD: Indicates if you started on emergency tax basis this year.

- TAX CREDIT TP: Personal Tax Credit’s value applied.

- PAY REL CODE: PRSI Class at which PRSI is calculated.

- TOTAL INS WEEKS: Total insurable weeks to date in this employment from start of the year.

- COMMENTS: Details of Employer contributions

- EMP’ER PRSI PER: Employer PRSI Contribution this period.

- EMP’ER PRSI TD: Employer PRSI Contribution this year.

- TP PENER: Employer Pension / PRSA Contribution this period.

- TY PENER: Employer Pension / PRSA Contribution this year.

- BIK YTD: Benefit in Kind paid this year.

Do you understand your payslip?

If not, hope this will help demystify what is frequently very confusing for most people.

Payslips can look different from company to company but in general, they tell you the same thing and are broken into four main categories. They are;

- Who you are and who is paying you

- What money you have coming in

- What money you have going out

- Totals for the year and your tax credits and allowances summary.

1. Who you are and who is paying you.

This is often across the very top of the payslip and is details like your PPSN and that of your employers. In simple terms, this is just a number with a letter at the end that identifies you on the revenue and social welfare system. This section will also often detail what dept you work in and your internal id such as your staff number.

2. What you have coming in.

In this section, which is usually on the left, you have details of what you are being paid. But don’t get carried away because this is your gross wages i.e. what you are getting before tax and anything else is taken out of it. In general, in this section you have all the money coming in but there can be exceptions to this. For example, sometimes you will see a pension contribution come out of this side. This is because pension contributions are tax-deductible (i.e. you get tax relief on them) and therefore some of the software that is used often deduct things like pension contributions from your gross wages before working out your tax.

This is what we like to call “pay yourself first”

3. What you have going out.

This is often on the left of the payslip and will deduct all the things to be taken off you before you get paid. They include things like Income tax/PAYE this is just straightforward tax, the money the government take off you to run the country, pay for hospitals etc. (supposedly anyway) USC – this was once the income and health levy but is now just a tax and is supposedly used for the same thing as above. It is the universal social charge was supposed to be temporary, but I think it is like a permanent temporary type thing now!!!

PRSI – This is Pay Related Social insurance and unlike taxes, this money is more like an insurance policy and pension contribution. It pays out when you retire (hopefully but we could do a whole piece on that item!) but it also pays you if you are off sick from work. It is often seen broken down between employer and employee contribution and your employer usually pays more than you do.

Subscriptions – if you have given written permission to pay for any subs like union fees etc you will see them come out here. This is also where you might see deductions for work sports and social or Christmas/holiday funds. Overpayments or corrections – sometimes if you see a deduction here it may because you were overpaid in the past and your employer is taking it back off you or it could be if you damaged or broke something and you are not being hit with a charge to replace it. Employers need to give you notice of this.

LPT – if you pay your land property tax through your payroll you should see it come out here.

4. Totals for the year.

This is where you can find some little gems. It will detail how much you are being paid today “current period” but also have much you paid so far this year under “YTD”. But it will also detail how much tax, USC and PRSI you have paid this year.

The gems, however, lie in the tax credits and allowances. Your “cut off point” is the amount of money you can earn before moving into the higher rate of tax. Sometimes your taxes can be out of kilter, for example, if you have moved job or you had some time off.

A quick check is to take the cut off point for this period and work it out for the year. So if you are paid monthly multiply it by 12, in 2019 a single person has a cut-off point of €35,300 so when you multiply it out if yours is less than this get on to revenue.

People who are overpaying taxes often never claim them back, there are lots of companies out there who specialise in doing personal tax returns and depending on which one you listen to, they claim that people who go to the bother of doing a tax return get a refund, on average between €800 & €1200.